The Power of Compound Interest

Portfolio management is the term used to describe the ongoing maintenance and attention that your investments should receive. It includes reviewing your asset allocation, adding new money and putting it to work, and reinvesting dividends. Most importantly, portfolio management is also about managing risk.

Long-term investors can leverage the power of compounding (more generally referred to as compound interest, specifically in the case of bonds, certificates of deposits, interest earned in a savings account for example). Compounding essentially means that interest is earned on top of interest. To understand the power of compounding, consider these three main points:

- The more time that money has to earn a return, the sooner is can begin compounding.

- Reinvesting contributes to compound growth.

- Excessive risk and leverage can potentially contribute to large losses, erasing the long-term effects of compounded returns.

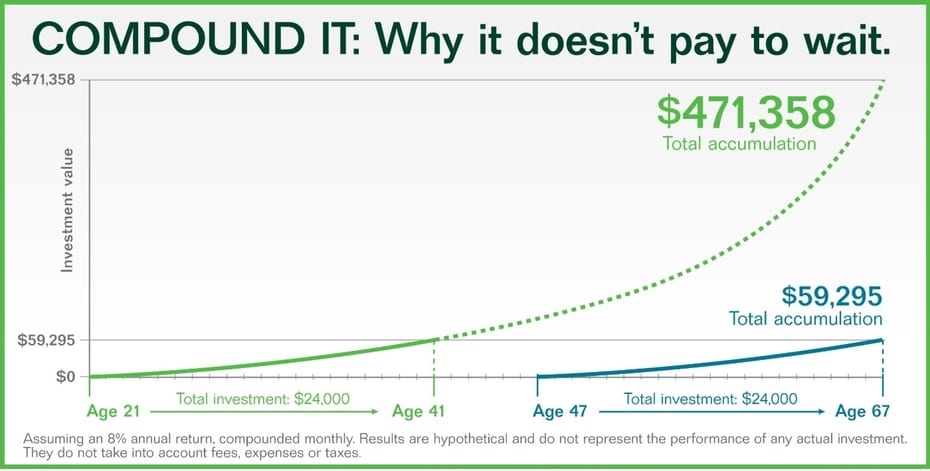

Albert Einstein is said to have described compound interest as “the eighth wonder of the world.” And when you look at the chart below, you can see why. The effects of compound interest are impressive, but it’s really just simple math!

The Basics

If you started saving with $1,000 and earned 5% in one year, you earned $50, right? Yes, and here’s where the magic of compounding happens. After the first year at 5% interest, you now have $1,050. Add the same 5% interest and you get $52.50 in the second year for a total of $1,102.50. In the third year, your total grows to $1,157.63 ($1,102.50 x 1.05). The extra gains on the first $50 in interest are small, but they begin to snowball over time.

The most important point is to continue to reinvest all compounded returns. Say you spent the $50 on clothing or a nice night out instead of keeping it invested, you would earn only another $50 in the second year instead of the compounded amount of $52.50. And there’s nothing wrong with treating yourself here and there, but when it comes to your long-term goals, you can’t have your compound growth and spend it too!

Managing Risk

Aside from the important factors of time and reinvestment, and their impact on compound growth, let’s talk about risk. Over periods of time, different asset classes, like stocks and bonds, grow at different rates. Bonds give investors a fixed rate of return and are generally viewed as “less risky.” Over a long period of time, the stock market and equities have historically given investors a greater rate of return, but not without some drawbacks. The stock market has the tendency to be volatile at times, leaving investors open to drawdowns and losses.

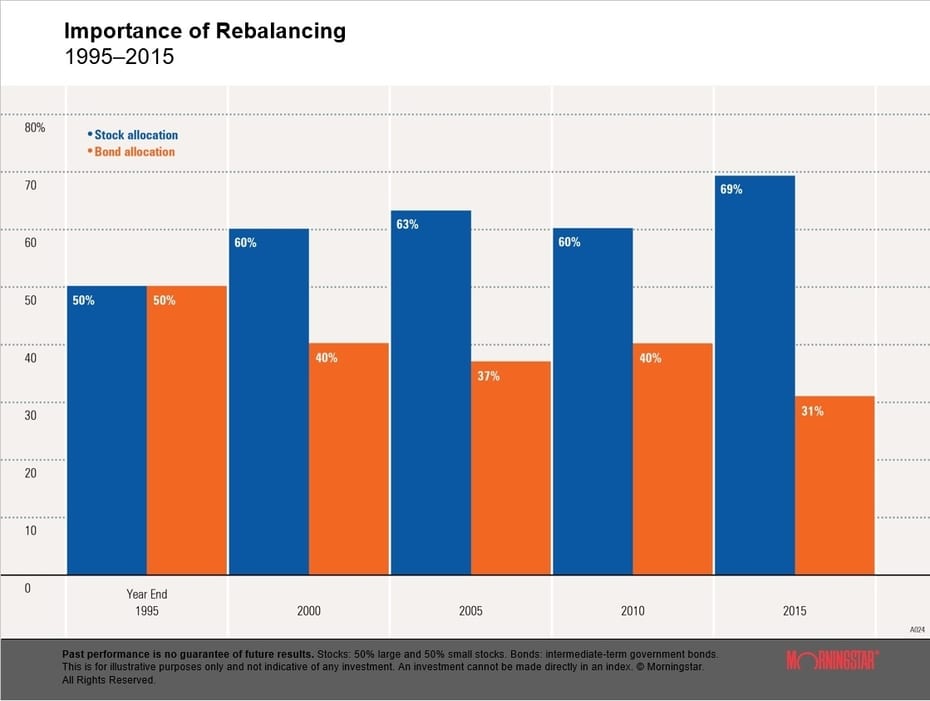

Imagine that you decided to allocate your portfolio and your wealth using a 50/50 mix of equity and fixed income, based on your risk tolerance and objectives. The following graph illustrates just how “unbalanced” your portfolio can become over time, (based on historical returns over a 20-year time period).

The original 50/50 asset allocation changes over each five-year period, becoming 60/40, then 63/47. The imbalance and heavier weighting towards equities creates more risk in the portfolio, which means greater variance in its value by 2025. More fluctuations cause the equity allocation to decrease to 60% by 2010 and increase again to 69% by the year 2015. The big takeaway here is that the portfolio allocation is very different from the original 50/50 where it started, and as the stock allocation increased so did the overall risk.

Semi-Annual Portfolio Checkups

In closing, a semi-annual portfolio checkup can go a long way towards maintaining the overall health of your retirement assets and financial well-being. You may want to consider a portfolio review at least twice a year to measure not only your risk tolerance, but also the various metrics of your portfolio to ensure you are not taking excess risk. At this time, it may be prudent to rebalance your portfolio and add to underweighted assets while reducing investment from overweighed assets.

Portfolio and financial management comes down to risk management, patience, and discipline. And remember, compound growth over time is your friend as a long-term investor, and learning how to maximize your investments is key to success. To chat about portfolio management, the markets, or financial planning, send me an email at info@Sacks-Associates.com