Why Riding Out Market Turbulence Can Work Better Than Trying to Time the Market

You may have heard the familiar mantra of financial professionals and pundits over the years and throughout market turmoil. Stay focused on the long-term. Don’t make trades based on emotions. Turn off the news and tune out the noise. Staying invested and holding your positions, even in the face of a sharp decline in the most widely followed indexes and perhaps your personal portfolio, will help you continue to march forward on your financial journey. Let’s explore the importance of staying invested, why we should avoid trading, and why market timing doesn’t really work.

Investing Can Be Uncertain

The only thing that we can be certain about is that stock prices will move up or move down on any given trading day, and the rapidity of those moves can be attributed to anything from earnings, economic data, current events and a variety of other factors. The point is that on a short term basis, no one knows with great confidence which way the market will go, by how much, and for how long. Because of these factors, and others, timing the market is extremely difficult. If you are easily spooked by news headlines or commentary and you move to more conservative investments, you risk missing a market recovery.

Market Snapbacks and Recoveries

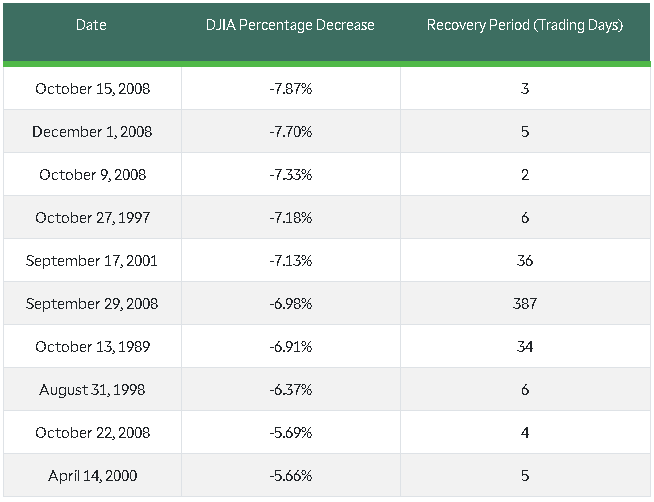

Based on historical data, after a sharp downturn stock prices usually rebound fairly quickly. Out of the 10 days when the Dow Jones Industrial Average (DJIA) dropped by more than 5%, the overall market rebounded within the following six trading sessions in all but three instances, one of which took place during the Great Recession in 2008. Investors who remained in their positions, instead of trading and trying to time market moves, were generally made whole within a few trading days.

Understanding how quickly stocks and securities tend to move and sometimes rebound can help keep market fluctuations in perspective. Here are four strategies you can use to stay cool when the market gets volatile:

Review Risk Tolerance, Goals, and Asset Allocation

Even though the market may be acting up, it still may not be too late to review your risk tolerance, asset allocation, and how these are affecting your long-term goals. If market fluctuations are worrying you, it is prudent to evaluate how your asset allocation and general weightings behave in different market conditions, the current economic environment, and if this is affecting your ability to meet your financial goals.

Scaling into Positions and Dollar-Cost Averaging

Investing a portion of money in increments into a position can allow us to possibly lower the average purchase price of an investment and can create a way for investors to manage risk. By buying in to investments in pieces, an investor might improve entry price into an investment, capture greater profit potential on the upside, and create a way to limit downside if conviction changes. Day traders and market timers are not the only market participants who have an opportunity to use strategy to meet their goals, investors and long-term holders have tools too. If you are participating in your employer sponsored plan and contributing each pay period, you’re likely already using some of these strategies to build your retirement savings and investments.

Avoid Screen Time

If you aren’t planning to spend down your investments within the next few years, there is generally no reason to constantly check your accounts online. Just because you have the ability to monitor your investments online in real-time doesn’t mean you should. Unless your conviction changes on one of your investments try and avoid hovering over your accounts. Consider setting up a schedule to check on your investments, whether it is once a week, once a quarter, or semi-annually. We never want to put our investments on auto-pilot, but constantly checking up on them has the potential to exacerbate emotional reactions to positive or negative swings. It’s only natural to show concern when the market takes a leg lower. It’s extremely important however to not overreact and take actions that could take you off-course, such as attempting to time the market and trade in and out of positions to capture small profits or prevent losses.

If you choose to invest on your own, make sure you create a plan and stick to it. And if you want some help, working with an experienced financial professional can help alleviate some of the concerns that investors may experience. A financial professional can help you understand the factors that influence the market, create a financial plan, and work to create an asset allocation that is appropriate for you. If you have any questions about asset allocation, economic trends, or just want to chat about the markets, you can contact me at [email protected]